Strong Earnings Expectations for US Large Cap Equities

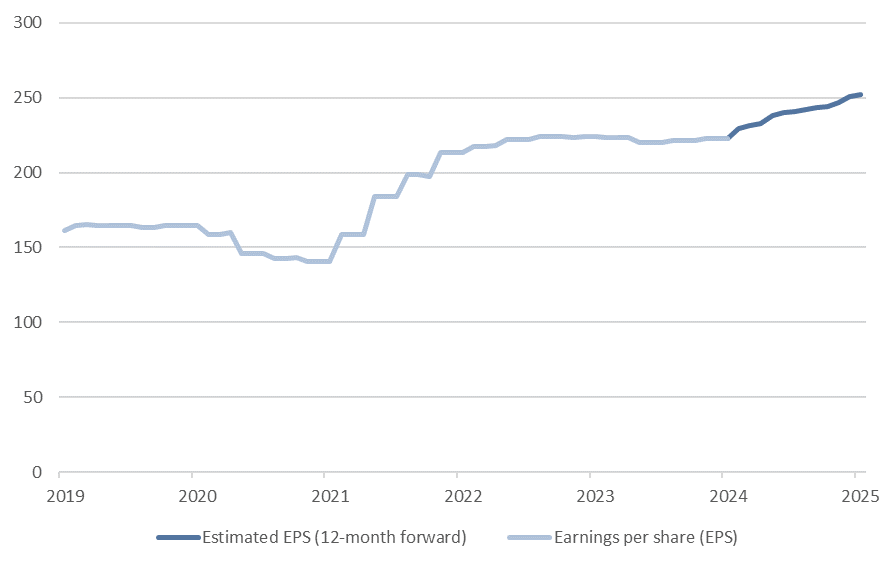

US equity market returns have been strong over the last 18 months, but US corporate profit growth has been anemic over that period (Fig. 1). However, in a reflection of the persistently strong US economy, equity analysts expect S&P 500 corporate profit growth of 13% over the next 12 months.

It’s worth noting that viewing earnings growth expectations for the entire US market muddles the overall picture. Equity analysts underestimated 2023 Mag 7 earnings by a significant margin, but now seem determined to avoid the same error in 2024 by forecasting 32% earnings growth for those seven stocks over the next 12 months. Such highly optimistic earnings expectations, coupled with already high valuations, present a risk to that segment of the equity market should companies fail to deliver.

However, the other 493 companies in the S&P 500 index have a significantly easier expected earnings hurdle to meet: 9.8% earnings growth over the next twelve months. While the overall outlook for equities is positive this year, it’s possible that too much good news has been priced into the Mag 7 and mega cap growth equities in general whereas market participants remain milquetoast about everything else.

Fig. 1: S&P 500 Earnings per share

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.